Business Hours

Monday - Friday

8:30 AM - 6:00 PM EST

ERISA Appeals vs Commercial Payer Appeals: Key Differences

When healthcare providers face denied claims, they can pursue two main appeal paths: ERISA appeals (governed by federal law) and commercial payer appeals (regulated by state laws and payer contracts). Both serve to recover lost revenue but differ significantly in rules, timelines, and strategies.

Key Takeaways:

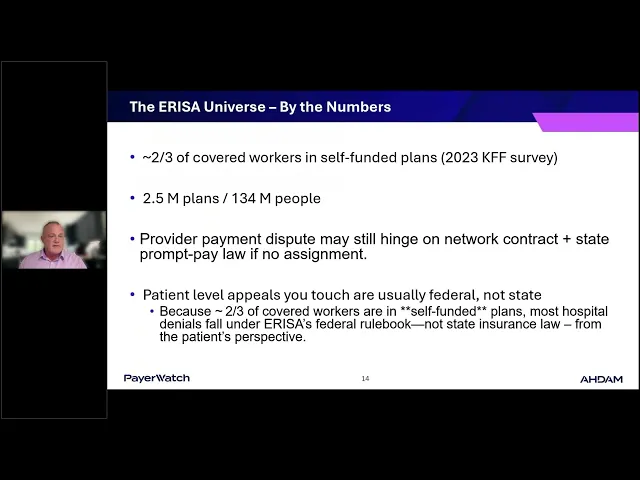

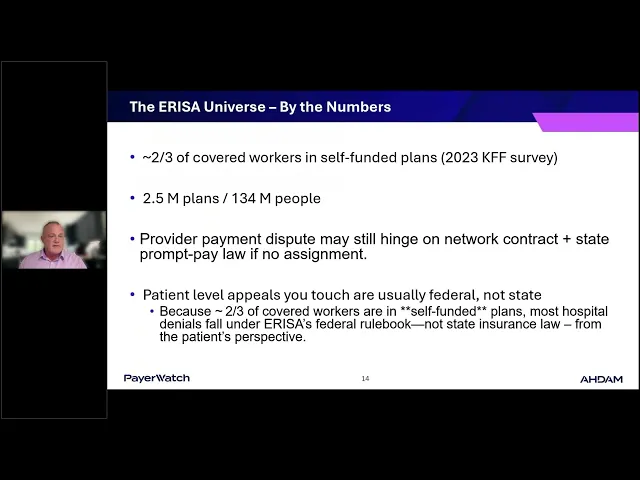

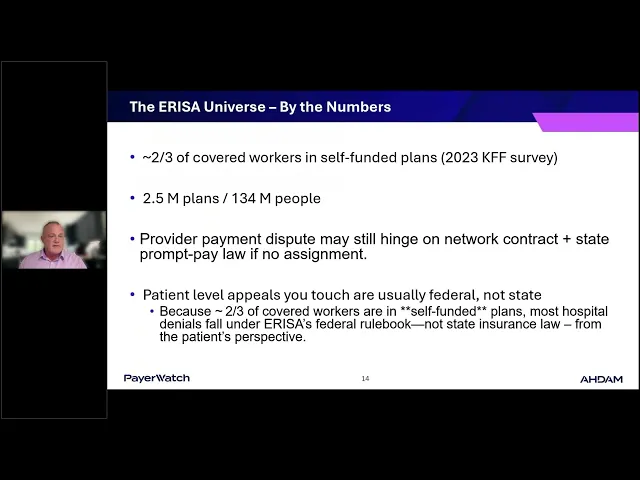

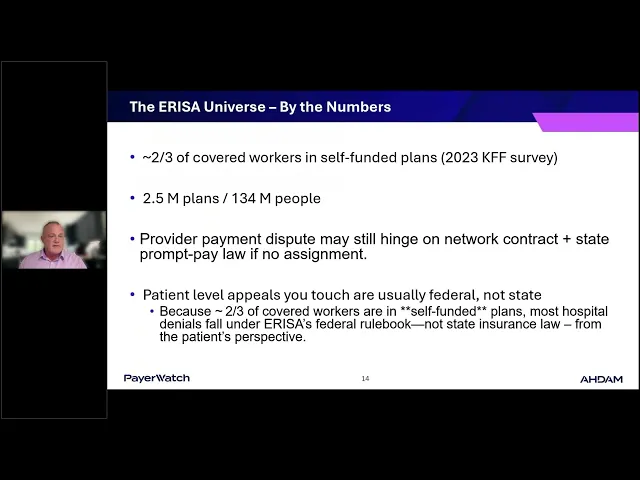

ERISA Appeals: Apply to self-insured plans under federal law. They offer standardized processes, extended timelines (up to 10 years for retroactive claims), and protections like anti-retaliation rules. Governed by the U.S. Department of Labor.

Commercial Payer Appeals: Apply to private insurance plans. These follow state-specific regulations and contract terms, making the process more variable and complex. Timelines and requirements vary widely by state and payer.

Quick Overview:

ERISA appeals provide a consistent framework but are underutilized (less than 1% of denied claims). They often yield better recovery rates due to federal preemption.

Commercial payer appeals are more common but demand tailored approaches for each payer and state, often requiring multiple attempts to overturn denials.

Understanding the distinctions between these two processes is critical for maximizing claim recovery and ensuring compliance. Below, we’ll break down their legal frameworks, processes, and impact on provider revenue.

Unlocking ERISA: How to Win Appeals When the Stakes Are High

Legal Framework and Governing Rules

The rules for handling ERISA and commercial payer appeals come from two distinct regulatory systems. For healthcare providers, understanding these differences is key to successfully navigating both processes.

ERISA Governing Laws

ERISA, short for the Employee Retirement Income Security Act of 1974, is a federal law that sets minimum standards for private retirement and health plans. It creates a nationwide regulatory framework that typically overrides state laws.

"ERISA requires plans to provide participants with plan information including important information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to establish a grievance and appeals process for participants to get benefits from their plans; gives participants the right to sue for benefits and breaches of fiduciary duty..."

The U.S. Department of Labor (DOL), through the Employee Benefits Security Administration (EBSA), oversees ERISA appeals. This federal oversight ensures consistent rules across the country and allows ERISA to override state laws and payer contracts - especially helpful for out-of-network claims. ERISA’s reach is extensive, applying to insurance policies that cover over 135 million beneficiaries.

ERISA also includes specific disclosure rules that benefit healthcare providers. For example, plan administrators must supply a Summary Plan Description (SPD) within 90 days of coverage starting and respond to requests for plan documents within 30 days. Additionally, ERISA includes anti-retaliation protections, ensuring that insurance companies cannot withhold benefits as a form of punishment. These protections extend to healthcare providers serving policyholders.

However, ERISA has its limits. It does not cover group health plans run by governmental entities, church-based plans for employees, or plans created solely to comply with workers' compensation, unemployment, or disability laws.

While ERISA provides a standardized, federally governed process, commercial payer appeals follow state-specific rules and contractual agreements.

Commercial Payer Governing Laws

Unlike ERISA’s consistent federal framework, commercial payer appeals operate under state-specific regulations and individual contracts, which can vary widely depending on the jurisdiction.

State insurance regulators are the primary authorities for overseeing private health insurance. They license insurers and enforce financial requirements specific to their state laws. This creates a patchwork of regulations that healthcare providers must navigate, often requiring different approaches in each state.

For commercial payer appeals, the terms of contracts between providers and payers play a central role. These agreements dictate the appeal processes, timelines, and requirements, which can differ significantly from one payer to another. Unlike ERISA, there’s no standardized process - providers must follow the specific terms outlined in each contract.

State-to-state variations add an extra layer of complexity. Each state has its own insurance codes, appeal rules, and consumer protection laws. For example, the process for appealing a denial in California will differ from the process in Texas or New York.

Another key difference is enforcement. While ERISA operates under federal authority, commercial payer appeals are governed by state laws and contracts. This means providers cannot rely on federal standards to challenge payer decisions. Instead, they must work within the constraints of state-specific rules, which can be more restrictive - especially for out-of-network claims.

State insurance departments are typically responsible for enforcing commercial appeal rules. This localized oversight can be beneficial in some cases, but it also means that enforcement and remedies vary depending on each state’s resources and priorities.

For healthcare providers, these differences underscore the need for state-specific knowledge and careful attention to contract details when handling commercial payer appeals. These legal distinctions shape the strategies providers must use to recover revenue.

Appeals Processes and Timelines

The appeals processes for ERISA plans and commercial payers differ significantly, creating unique challenges for healthcare providers trying to recover revenue. Each system comes with its own set of rules, documentation requirements, and deadlines, all of which can impact the success of an appeal.

ERISA Appeals Process

The ERISA appeals process is governed by federal law, offering specific protections and rights for participants. When a claim is denied, the plan administrator is required to provide a detailed denial letter. This letter must include the reasons for the denial, the relevant sections of the plan supporting the decision, and clear instructions on how to appeal the decision.

"The most important way to assert your rights and collect the benefits you deserve is to file an ERISA appeal." - Peace Law Firm

One key feature of this process is the opportunity for providers to submit additional evidence and arguments to support their case. This not only increases the chances of overturning the denial but also helps create a robust record for potential legal action if the administrative process doesn’t resolve the issue. Importantly, providers must exhaust all administrative remedies before taking the matter to federal court. ERISA also includes anti-retaliation protections, shielding providers from punitive actions by insurers.

Another advantage of ERISA appeals is the extended timeline for addressing underpayments or denials. Claims can be pursued retroactively for up to ten years, which can be a game-changer for providers dealing with long-standing payment issues.

Commercial Payer Appeals Process

Commercial payer appeals, on the other hand, are governed by a patchwork of state laws and individual contracts, making the process more fragmented and complex. Providers must navigate varying requirements, which often include multiple levels of review, such as external reviews conducted by state agencies or the Department of Health and Human Services.

When prior authorization is denied, providers often need to include a statement of medical necessity from the ordering physician. Appeal letters must be customized to address the specific payer and jurisdiction, explaining the medical necessity of the service, detailing the tests performed, and citing published evidence to support the claim. Because these appeals are contractually driven, the procedures, deadlines, and documentation requirements can vary widely, making it essential for providers to thoroughly review each payer contract.

This variability demands a flexible and organized approach to ensure deadlines are met and appeals are submitted correctly.

Timeline Comparison

The timelines for ERISA and commercial payer appeals differ significantly, which can affect how providers approach their revenue recovery strategies.

Under ERISA, the process is more standardized. Claim decisions are typically made within 45 days, with an additional 45-day extension allowed for disability appeals. Accidental death claims must be appealed within 60 days. After administrative remedies are exhausted, there’s no strict federal deadline for further legal action, as courts often rely on state statutes of limitations.

In contrast, commercial payer timelines are far less predictable. They vary depending on state regulations and the terms of individual plan agreements. Some plans may request additional documentation or grant extensions, which can stretch the process well beyond ERISA’s more structured timeframes. In some cases, it may take over a year to fully resolve an appeal and recover revenue.

These differences highlight the importance of strategic planning. ERISA’s federal framework provides clearer deadlines, while commercial payer appeals require careful tracking of multiple, often shifting, timelines. Providers must maintain meticulous records of all deadlines and ensure timely submissions to protect their rights and maximize recovery efforts.

Key Differences Comparison

When comparing ERISA and commercial payer appeals, their distinctions become clear through a side-by-side review. ERISA appeals operate under a uniform federal framework, while commercial payer appeals are shaped by diverse state laws and specific contract terms.

ERISA is governed by federal law, which typically overrides state regulations and payer contracts. This federal oversight ensures consistency across all states. For instance, private self-insured employer-sponsored plans fall under the jurisdiction of the U.S. Department of Labor, while state and local government plans are monitored by the Centers for Medicare and Medicaid Services (CMS). On the other hand, commercial payer appeals are regulated at the state level, applying to a variety of insurance products that don’t fall under ERISA.

The scope of coverage also diverges significantly. ERISA oversees benefits for about 165 million individuals under 65 with employer-sponsored coverage as of 2023. This includes a wide range of plans, such as health, disability, and life insurance. Commercial payer appeals, however, vary depending on the state and the specific type of plan.

Another key difference lies in documentation requirements. ERISA enforces standardized and timely documentation, whereas commercial payer appeals follow state-specific rules, which can differ greatly depending on the jurisdiction.

Side-by-Side Comparison Table

Attribute | ERISA Appeals | Commercial Payer Appeals |

|---|---|---|

Governing Law | Federal Law (ERISA) | State Law, Contract Law |

Regulatory Authority | U.S. Department of Labor, CMS | State Insurance Commissioners |

Coverage Scope | 165 million employer-sponsored plan members | Varies by state and plan type |

Appeal Timeline | 45 days (+ extensions available) | Varies by state and contract |

Appeal Deadline | 180 days from denial notice | Varies by state and contract |

Look-back Period | Up to 10 years | Limited by state law and contract terms |

Documentation Response | 30 days for plan documents | Varies by state requirements |

Resolution Venue | Federal Courts | State-level processes |

Legal Remedies | Exclusive federal civil remedies | State-specific remedies |

The differences between these frameworks have a direct impact on financial recovery strategies in healthcare. Despite a 23% increase in claim denials from 2016 to 2020, hospitals rely on ERISA appeals for less than 1% of all denied claims. This underutilization is notable, given the potential benefits ERISA offers.

Enforcement mechanisms also highlight the contrast. ERISA provides exclusive but limited civil remedies, allowing providers to escalate cases to federal court once administrative remedies are exhausted. In contrast, disputes involving commercial payers are resolved through state-level processes, which vary widely.

These regulatory and procedural differences not only shape appeal outcomes but also influence how healthcare providers approach revenue recovery. ERISA’s federal preemption offers a significant advantage by overriding payer contracts and state laws in most cases. Providers working with ERISA plans benefit from a consistent legal foundation, while those handling commercial payer appeals must navigate a patchwork of state regulations and contract-specific terms.

Ultimately, these contrasts explain why ERISA appeals often lead to better recovery rates and more stable long-term revenue opportunities. Meanwhile, commercial payer appeals demand tailored strategies that align with unique state and contract requirements.

Impact on Healthcare Revenue Recovery

The differences between ERISA and commercial payer appeals significantly shape how healthcare providers recover lost revenue. These distinctions influence their strategies and determine which methods are most effective for improving financial outcomes.

Effect on Claim Recovery Approaches

ERISA appeals provide a distinct advantage for healthcare providers looking to recover revenue. Unlike commercial payer appeals, ERISA allows recovery on older claims that typically fall outside standard statutory limits. This opens up opportunities to reclaim funds that might otherwise be written off as losses.

For example, a 13-hospital system managed to recover $87,003 in its first month of ERISA appeals and a total of $6,551,887 over 25 months. They also had $7.7 million under appeal and $14.8 million pending. In another case, a healthcare provider grew its ERISA recovery from $141,000 in the first month to $1.1 million by the fourth month.

On the other hand, commercial payer appeals present a tougher challenge. Private payers deny about 15% of first-pass claims. While 54% of these denials are eventually overturned, it often requires multiple attempts, adding both time and expense. Each appeal costs around $44, and the average financial loss per denial exceeds $14,000. Alarmingly, 22% of healthcare organizations report losing over $500,000 annually due to denied claims.

A key to success in ERISA appeals lies in adopting an educational rather than adversarial approach. Andre Kus, CEO of JXH Recovery, explains:

"JXH Recovery understands hospitals have long-term relationships with insurance companies, so we try to use an educational approach in our negotiations with payers."

This strategy leverages ERISA's federal preemption, which overrides most payer contracts and state laws, giving providers a stronger position in negotiations.

In contrast, commercial payer appeals require a more tailored strategy. Providers must account for state-specific regulations, contract terms, and the nuances of different insurance products. Medicare Advantage plans add another layer of complexity, with denials increasing by nearly 56% and those tied to net patient revenue rising by more than 63%.

These operational differences emphasize the importance of specialized expertise, which is explored further below.

Role of Specialized Services

The growing complexity of ERISA and commercial payer appeals highlights the need for specialized services. Managing these appeals internally can be overwhelming, especially with the rise in claim denials.

JXH Recovery offers targeted solutions for both types of appeals. Their ERISA service focuses on recovering claims that seem unrecoverable through conventional methods, while their commercial payer service navigates the intricate maze of state regulations and private insurer requirements. By using a performance-based model, they eliminate upfront costs, reducing financial risk for providers.

The scale of unpaid claims in the healthcare industry underscores the importance of expertise. A survey of 772 hospitals found that half reported having over $100 million in unpaid claims older than six months, amounting to more than $6.4 billion in delayed or denied payments.

The knowledge required for ERISA appeals differs greatly from that needed for commercial payer appeals. ERISA cases rely on federal laws, extensive case history, and amendments, while commercial appeals demand familiarity with state regulations and individual contracts. This difference explains why providers often achieve better results when working with recovery specialists instead of handling appeals internally.

Beyond immediate recoveries, ERISA appeals can uncover patterns of underpayment through data analysis, strengthening future claims. Similarly, specialists managing commercial payer appeals can identify trends in denials and overturned claims, helping providers refine their submission strategies. These insights can lead to long-term financial improvements and better claim management.

Compliance Requirements and Best Practices

Navigating the complexities of regulatory frameworks is crucial for healthcare providers aiming to optimize revenue recovery through ERISA and commercial payer appeals. Understanding the specific obligations tied to each process ensures compliance and sets the stage for successful outcomes.

Required Compliance Steps

ERISA Compliance Essentials

ERISA appeals fall under federal law, which provides uniform regulations across all states. The Department of Labor mandates that healthcare providers adhere to several key requirements when pursuing these appeals. For example:

Plans must provide a Summary Plan Description (SPD) within 90 days and deliver requested plan documents within 30 days.

Participants have the right to access all "relevant" documents and records at no cost.

If a denial or appeal is based on an internal rule, guideline, or protocol, the notice must identify it and either include the rule or state that a copy will be provided upon request.

To ensure impartiality, the individual reviewing an ERISA appeal cannot be the same person - or report to the person - who made the initial claim decision.

Plans must update their internal claims and appeals procedures and revise the corresponding SPD sections accordingly.

Extensions for plan responses are limited to exceptional situations beyond the plan's control.

Commercial Payer Compliance Differences

Unlike ERISA, commercial payer appeals are governed by state-specific requirements. These include varying forms, submission methods, and evidentiary standards. Providers must also meticulously document all communications and actions related to each claim and appeal, as this is critical for compliance and success.

Managing Timelines

ERISA appeals have a strict 180-day filing deadline, which supersedes state laws and contractual terms. In contrast, commercial payer deadlines range from 30 to 180 days depending on the payer. Additionally, employers must respond to written requests for ERISA-related documents within 30 days to avoid penalties of up to $110 per day.

These foundational compliance steps pave the way for implementing best practices that enhance appeal outcomes.

Best Practices for Appeal Success

Adhering to compliance requirements is just the beginning. To improve revenue recovery, providers should adopt strategies that strengthen their appeals process.

Clear and Comprehensive Documentation

Accurate documentation is the backbone of any successful appeal. Providers need to ensure their records and coding clearly establish the medical necessity of the services provided.

Standardized Templates for Appeals

Using standardized templates can streamline the appeals process and improve consistency. Holly Ridge, Manager of Medical Necessity and Authorization Denials at Duke Health, highlights their importance:

"Templates look cleaner, more organized, and can look more professional. Templates can also help provide content reminders to staff as they write their appeals."

Templates should address various scenarios, such as authorization denials, Medicare denials, and commercial payer denials. Many electronic billing systems even offer preloaded templates to simplify this process further.

Leveraging Supporting Evidence

Strong appeals rely on robust supporting evidence. Providers should reference relevant payer policies (e.g., Medicare NCDs, LCDs, and Medicare Advantage policies), as well as federal and state regulations like the ACA and ERISA. Supplementing these with society guidelines, medical literature, and NCCI guidelines can further strengthen the case.

Tracking and Analyzing Denials

Effective appeals management requires systematic tracking. Providers can use spreadsheets, billing work-queues, or integrated appeals management systems to monitor open denials. Analyzing denial trends can help identify areas for improvement, refine coding practices, and focus staff training efforts.

Strengthening ERISA Appeals

For ERISA appeals, having well-crafted assignments of benefits (AOBs) is essential. A strong AOB allows providers to act on behalf of patients during the appeals process, ensuring all rights under ERISA are upheld.

Tackling Industry Challenges

Managing appeals effectively is critical to minimizing revenue loss. Even when claims seem clean, third-party payers may deny them initially, banking on the likelihood that providers won’t appeal. This practice leads to significant financial losses, as data shows that 50% of providers do not contest these incorrect denials. Moreover, poorly constructed appeals can further disadvantage providers by preserving payer capital.

A robust appeals process not only addresses these challenges but also boosts overall practice revenue. Some providers choose to partner with specialized services like JXH Recovery, which operates on a performance-based model, eliminating upfront financial risks while managing the intricate demands of ERISA and commercial payer appeals.

Conclusion

ERISA and commercial payer appeals represent two distinct avenues for healthcare revenue recovery, each with its own rules, challenges, and opportunities. ERISA appeals operate under federal law, while commercial payer appeals are subject to state-specific regulations. This regulatory divide creates notable differences in how providers approach and achieve financial recovery.

Grasping these distinctions is essential for improving revenue recovery efforts. For instance, major insurers like UnitedHealth Group reported a staggering 44% profit increase in the first quarter of 2021, which adds pressure on healthcare providers to recover revenue lost to denied claims. Despite this, ERISA appeals are used in less than one percent of all denied claims, leaving a massive opportunity untapped.

The complexity of ERISA appeals often deters providers, as many financial teams lack the expertise needed to handle federal-level disputes effectively. This issue is compounded by the fact that half of healthcare providers never challenge incorrect denials, allowing insurers to hold onto funds that should be reimbursed.

Specialized expertise plays a key role in maximizing appeal outcomes. Insurers routinely deny or underpay claims, relying on the assumption that policyholders won’t pursue appeals. Firms specializing in appeals can analyze denial patterns, often uncovering systematic underpayments that insurers struggle to justify. These firms frequently employ former insurance professionals to negotiate directly with payers, securing full payments without incurring legal expenses. This approach is not only effective but also cost-efficient, as attorney-led claims appeals can be eight times more expensive than other methods.

For healthcare providers aiming to recover lost revenue, success lies in recognizing that ERISA and commercial payer appeals require tailored strategies and deep expertise. Organizations like JXH Recovery offer performance-based solutions that minimize upfront financial risks while applying the specialized knowledge needed to navigate these complex processes. By leveraging such expertise, providers can turn previously written-off claims into recovered revenue, strengthening their financial position in an increasingly challenging landscape.

FAQs

What are the main benefits of choosing ERISA appeals over commercial payer appeals for healthcare providers?

Advantages of ERISA Appeals for Healthcare Providers

ERISA appeals provide healthcare providers with a valuable chance to address underpaid or denied claims through a structured review process. This process is designed to ensure a thorough and equitable review, giving providers a second opportunity to recover revenue that might otherwise slip through the cracks.

One standout benefit of ERISA appeals is their faster decision timelines compared to traditional commercial payer appeals. This efficiency not only helps providers address claim disputes more quickly but also reduces the administrative burden on their teams. By utilizing ERISA appeals, providers can protect their financial health while streamlining their claim resolution efforts.

What are the main differences in timelines and documentation requirements for ERISA and commercial payer appeals, and how can providers effectively handle them?

The timelines and documentation requirements for ERISA appeals and commercial payer appeals differ quite a bit. ERISA appeals come with stricter deadlines, typically requiring submissions within 60 to 180 days after a denial. Decisions on these appeals are usually made within 60 days of filing. In contrast, commercial payer appeals often provide more leeway, with deadlines that can range widely - sometimes stretching several years, depending on the payer and specific circumstances.

To navigate these differences successfully, healthcare providers should consider the following strategies:

Keep meticulous records of all claims and denials to avoid missing critical details.

Develop a reliable system to monitor appeal deadlines for both ERISA and commercial payers.

Focus on ERISA appeals first due to their tighter deadlines, while preparing for the potentially extended timelines of commercial appeals.

By staying organized and proactive, providers can better manage these processes and increase the likelihood of recovering claims in both cases.

Why don’t healthcare providers use ERISA appeals more often, even though they can improve recovery rates?

Healthcare providers often shy away from ERISA appeals because the process can seem daunting. The rules and procedures involved are intricate, and many providers aren't fully aware of the rights and benefits these appeals can unlock. This gap in understanding often results in missed chances to recover claims.

What makes ERISA appeals even more challenging is that they’re governed by federal regulations, which adds layers of complexity. They tend to require more time and resources than standard commercial payer appeals. On top of that, many providers lack the specific expertise or tools needed to handle these claims efficiently. Because of this, even though ERISA appeals have the potential to boost revenue recovery significantly, they often go unused.

Blogs

Blogs

Blogs

Read More

02/01/2025

5 mins

ERISA Appeals vs Commercial Payer Appeals: Key Differences

Read More

02/01/2025

5 mins

ERISA Appeals vs Commercial Payer Appeals: Key Differences

Read More

02/01/2025

5 mins

ERISA Appeals vs Commercial Payer Appeals: Key Differences

Read More

02/01/2025

5 mins

5 Steps to Appeal Denied Healthcare Claims

Read More

02/01/2025

5 mins

5 Steps to Appeal Denied Healthcare Claims

Read More

02/01/2025

5 mins

5 Steps to Appeal Denied Healthcare Claims

Reclaim Your Revenue

Is your facility losing money to denied claims? Let's fix that. Reach out today to learn how our recovery model can strengthen your bottom line without disrupting your operations.

Reclaim Your Revenue

Is your facility losing money to denied claims? Let's fix that. Reach out today to learn how our recovery model can strengthen your bottom line without disrupting your operations.

Reclaim Your Revenue

Is your facility losing money to denied claims? Let's fix that. Reach out today to learn how our recovery model can strengthen your bottom line without disrupting your operations.

Business Hours

Monday - Friday

8:30 AM - 6:00 PM EST

ERISA Appeals vs Commercial Payer Appeals: Key Differences

When healthcare providers face denied claims, they can pursue two main appeal paths: ERISA appeals (governed by federal law) and commercial payer appeals (regulated by state laws and payer contracts). Both serve to recover lost revenue but differ significantly in rules, timelines, and strategies.

Key Takeaways:

ERISA Appeals: Apply to self-insured plans under federal law. They offer standardized processes, extended timelines (up to 10 years for retroactive claims), and protections like anti-retaliation rules. Governed by the U.S. Department of Labor.

Commercial Payer Appeals: Apply to private insurance plans. These follow state-specific regulations and contract terms, making the process more variable and complex. Timelines and requirements vary widely by state and payer.

Quick Overview:

ERISA appeals provide a consistent framework but are underutilized (less than 1% of denied claims). They often yield better recovery rates due to federal preemption.

Commercial payer appeals are more common but demand tailored approaches for each payer and state, often requiring multiple attempts to overturn denials.

Understanding the distinctions between these two processes is critical for maximizing claim recovery and ensuring compliance. Below, we’ll break down their legal frameworks, processes, and impact on provider revenue.

Unlocking ERISA: How to Win Appeals When the Stakes Are High

Legal Framework and Governing Rules

The rules for handling ERISA and commercial payer appeals come from two distinct regulatory systems. For healthcare providers, understanding these differences is key to successfully navigating both processes.

ERISA Governing Laws

ERISA, short for the Employee Retirement Income Security Act of 1974, is a federal law that sets minimum standards for private retirement and health plans. It creates a nationwide regulatory framework that typically overrides state laws.

"ERISA requires plans to provide participants with plan information including important information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to establish a grievance and appeals process for participants to get benefits from their plans; gives participants the right to sue for benefits and breaches of fiduciary duty..."

The U.S. Department of Labor (DOL), through the Employee Benefits Security Administration (EBSA), oversees ERISA appeals. This federal oversight ensures consistent rules across the country and allows ERISA to override state laws and payer contracts - especially helpful for out-of-network claims. ERISA’s reach is extensive, applying to insurance policies that cover over 135 million beneficiaries.

ERISA also includes specific disclosure rules that benefit healthcare providers. For example, plan administrators must supply a Summary Plan Description (SPD) within 90 days of coverage starting and respond to requests for plan documents within 30 days. Additionally, ERISA includes anti-retaliation protections, ensuring that insurance companies cannot withhold benefits as a form of punishment. These protections extend to healthcare providers serving policyholders.

However, ERISA has its limits. It does not cover group health plans run by governmental entities, church-based plans for employees, or plans created solely to comply with workers' compensation, unemployment, or disability laws.

While ERISA provides a standardized, federally governed process, commercial payer appeals follow state-specific rules and contractual agreements.

Commercial Payer Governing Laws

Unlike ERISA’s consistent federal framework, commercial payer appeals operate under state-specific regulations and individual contracts, which can vary widely depending on the jurisdiction.

State insurance regulators are the primary authorities for overseeing private health insurance. They license insurers and enforce financial requirements specific to their state laws. This creates a patchwork of regulations that healthcare providers must navigate, often requiring different approaches in each state.

For commercial payer appeals, the terms of contracts between providers and payers play a central role. These agreements dictate the appeal processes, timelines, and requirements, which can differ significantly from one payer to another. Unlike ERISA, there’s no standardized process - providers must follow the specific terms outlined in each contract.

State-to-state variations add an extra layer of complexity. Each state has its own insurance codes, appeal rules, and consumer protection laws. For example, the process for appealing a denial in California will differ from the process in Texas or New York.

Another key difference is enforcement. While ERISA operates under federal authority, commercial payer appeals are governed by state laws and contracts. This means providers cannot rely on federal standards to challenge payer decisions. Instead, they must work within the constraints of state-specific rules, which can be more restrictive - especially for out-of-network claims.

State insurance departments are typically responsible for enforcing commercial appeal rules. This localized oversight can be beneficial in some cases, but it also means that enforcement and remedies vary depending on each state’s resources and priorities.

For healthcare providers, these differences underscore the need for state-specific knowledge and careful attention to contract details when handling commercial payer appeals. These legal distinctions shape the strategies providers must use to recover revenue.

Appeals Processes and Timelines

The appeals processes for ERISA plans and commercial payers differ significantly, creating unique challenges for healthcare providers trying to recover revenue. Each system comes with its own set of rules, documentation requirements, and deadlines, all of which can impact the success of an appeal.

ERISA Appeals Process

The ERISA appeals process is governed by federal law, offering specific protections and rights for participants. When a claim is denied, the plan administrator is required to provide a detailed denial letter. This letter must include the reasons for the denial, the relevant sections of the plan supporting the decision, and clear instructions on how to appeal the decision.

"The most important way to assert your rights and collect the benefits you deserve is to file an ERISA appeal." - Peace Law Firm

One key feature of this process is the opportunity for providers to submit additional evidence and arguments to support their case. This not only increases the chances of overturning the denial but also helps create a robust record for potential legal action if the administrative process doesn’t resolve the issue. Importantly, providers must exhaust all administrative remedies before taking the matter to federal court. ERISA also includes anti-retaliation protections, shielding providers from punitive actions by insurers.

Another advantage of ERISA appeals is the extended timeline for addressing underpayments or denials. Claims can be pursued retroactively for up to ten years, which can be a game-changer for providers dealing with long-standing payment issues.

Commercial Payer Appeals Process

Commercial payer appeals, on the other hand, are governed by a patchwork of state laws and individual contracts, making the process more fragmented and complex. Providers must navigate varying requirements, which often include multiple levels of review, such as external reviews conducted by state agencies or the Department of Health and Human Services.

When prior authorization is denied, providers often need to include a statement of medical necessity from the ordering physician. Appeal letters must be customized to address the specific payer and jurisdiction, explaining the medical necessity of the service, detailing the tests performed, and citing published evidence to support the claim. Because these appeals are contractually driven, the procedures, deadlines, and documentation requirements can vary widely, making it essential for providers to thoroughly review each payer contract.

This variability demands a flexible and organized approach to ensure deadlines are met and appeals are submitted correctly.

Timeline Comparison

The timelines for ERISA and commercial payer appeals differ significantly, which can affect how providers approach their revenue recovery strategies.

Under ERISA, the process is more standardized. Claim decisions are typically made within 45 days, with an additional 45-day extension allowed for disability appeals. Accidental death claims must be appealed within 60 days. After administrative remedies are exhausted, there’s no strict federal deadline for further legal action, as courts often rely on state statutes of limitations.

In contrast, commercial payer timelines are far less predictable. They vary depending on state regulations and the terms of individual plan agreements. Some plans may request additional documentation or grant extensions, which can stretch the process well beyond ERISA’s more structured timeframes. In some cases, it may take over a year to fully resolve an appeal and recover revenue.

These differences highlight the importance of strategic planning. ERISA’s federal framework provides clearer deadlines, while commercial payer appeals require careful tracking of multiple, often shifting, timelines. Providers must maintain meticulous records of all deadlines and ensure timely submissions to protect their rights and maximize recovery efforts.

Key Differences Comparison

When comparing ERISA and commercial payer appeals, their distinctions become clear through a side-by-side review. ERISA appeals operate under a uniform federal framework, while commercial payer appeals are shaped by diverse state laws and specific contract terms.

ERISA is governed by federal law, which typically overrides state regulations and payer contracts. This federal oversight ensures consistency across all states. For instance, private self-insured employer-sponsored plans fall under the jurisdiction of the U.S. Department of Labor, while state and local government plans are monitored by the Centers for Medicare and Medicaid Services (CMS). On the other hand, commercial payer appeals are regulated at the state level, applying to a variety of insurance products that don’t fall under ERISA.

The scope of coverage also diverges significantly. ERISA oversees benefits for about 165 million individuals under 65 with employer-sponsored coverage as of 2023. This includes a wide range of plans, such as health, disability, and life insurance. Commercial payer appeals, however, vary depending on the state and the specific type of plan.

Another key difference lies in documentation requirements. ERISA enforces standardized and timely documentation, whereas commercial payer appeals follow state-specific rules, which can differ greatly depending on the jurisdiction.

Side-by-Side Comparison Table

Attribute | ERISA Appeals | Commercial Payer Appeals |

|---|---|---|

Governing Law | Federal Law (ERISA) | State Law, Contract Law |

Regulatory Authority | U.S. Department of Labor, CMS | State Insurance Commissioners |

Coverage Scope | 165 million employer-sponsored plan members | Varies by state and plan type |

Appeal Timeline | 45 days (+ extensions available) | Varies by state and contract |

Appeal Deadline | 180 days from denial notice | Varies by state and contract |

Look-back Period | Up to 10 years | Limited by state law and contract terms |

Documentation Response | 30 days for plan documents | Varies by state requirements |

Resolution Venue | Federal Courts | State-level processes |

Legal Remedies | Exclusive federal civil remedies | State-specific remedies |

The differences between these frameworks have a direct impact on financial recovery strategies in healthcare. Despite a 23% increase in claim denials from 2016 to 2020, hospitals rely on ERISA appeals for less than 1% of all denied claims. This underutilization is notable, given the potential benefits ERISA offers.

Enforcement mechanisms also highlight the contrast. ERISA provides exclusive but limited civil remedies, allowing providers to escalate cases to federal court once administrative remedies are exhausted. In contrast, disputes involving commercial payers are resolved through state-level processes, which vary widely.

These regulatory and procedural differences not only shape appeal outcomes but also influence how healthcare providers approach revenue recovery. ERISA’s federal preemption offers a significant advantage by overriding payer contracts and state laws in most cases. Providers working with ERISA plans benefit from a consistent legal foundation, while those handling commercial payer appeals must navigate a patchwork of state regulations and contract-specific terms.

Ultimately, these contrasts explain why ERISA appeals often lead to better recovery rates and more stable long-term revenue opportunities. Meanwhile, commercial payer appeals demand tailored strategies that align with unique state and contract requirements.

Impact on Healthcare Revenue Recovery

The differences between ERISA and commercial payer appeals significantly shape how healthcare providers recover lost revenue. These distinctions influence their strategies and determine which methods are most effective for improving financial outcomes.

Effect on Claim Recovery Approaches

ERISA appeals provide a distinct advantage for healthcare providers looking to recover revenue. Unlike commercial payer appeals, ERISA allows recovery on older claims that typically fall outside standard statutory limits. This opens up opportunities to reclaim funds that might otherwise be written off as losses.

For example, a 13-hospital system managed to recover $87,003 in its first month of ERISA appeals and a total of $6,551,887 over 25 months. They also had $7.7 million under appeal and $14.8 million pending. In another case, a healthcare provider grew its ERISA recovery from $141,000 in the first month to $1.1 million by the fourth month.

On the other hand, commercial payer appeals present a tougher challenge. Private payers deny about 15% of first-pass claims. While 54% of these denials are eventually overturned, it often requires multiple attempts, adding both time and expense. Each appeal costs around $44, and the average financial loss per denial exceeds $14,000. Alarmingly, 22% of healthcare organizations report losing over $500,000 annually due to denied claims.

A key to success in ERISA appeals lies in adopting an educational rather than adversarial approach. Andre Kus, CEO of JXH Recovery, explains:

"JXH Recovery understands hospitals have long-term relationships with insurance companies, so we try to use an educational approach in our negotiations with payers."

This strategy leverages ERISA's federal preemption, which overrides most payer contracts and state laws, giving providers a stronger position in negotiations.

In contrast, commercial payer appeals require a more tailored strategy. Providers must account for state-specific regulations, contract terms, and the nuances of different insurance products. Medicare Advantage plans add another layer of complexity, with denials increasing by nearly 56% and those tied to net patient revenue rising by more than 63%.

These operational differences emphasize the importance of specialized expertise, which is explored further below.

Role of Specialized Services

The growing complexity of ERISA and commercial payer appeals highlights the need for specialized services. Managing these appeals internally can be overwhelming, especially with the rise in claim denials.

JXH Recovery offers targeted solutions for both types of appeals. Their ERISA service focuses on recovering claims that seem unrecoverable through conventional methods, while their commercial payer service navigates the intricate maze of state regulations and private insurer requirements. By using a performance-based model, they eliminate upfront costs, reducing financial risk for providers.

The scale of unpaid claims in the healthcare industry underscores the importance of expertise. A survey of 772 hospitals found that half reported having over $100 million in unpaid claims older than six months, amounting to more than $6.4 billion in delayed or denied payments.

The knowledge required for ERISA appeals differs greatly from that needed for commercial payer appeals. ERISA cases rely on federal laws, extensive case history, and amendments, while commercial appeals demand familiarity with state regulations and individual contracts. This difference explains why providers often achieve better results when working with recovery specialists instead of handling appeals internally.

Beyond immediate recoveries, ERISA appeals can uncover patterns of underpayment through data analysis, strengthening future claims. Similarly, specialists managing commercial payer appeals can identify trends in denials and overturned claims, helping providers refine their submission strategies. These insights can lead to long-term financial improvements and better claim management.

Compliance Requirements and Best Practices

Navigating the complexities of regulatory frameworks is crucial for healthcare providers aiming to optimize revenue recovery through ERISA and commercial payer appeals. Understanding the specific obligations tied to each process ensures compliance and sets the stage for successful outcomes.

Required Compliance Steps

ERISA Compliance Essentials

ERISA appeals fall under federal law, which provides uniform regulations across all states. The Department of Labor mandates that healthcare providers adhere to several key requirements when pursuing these appeals. For example:

Plans must provide a Summary Plan Description (SPD) within 90 days and deliver requested plan documents within 30 days.

Participants have the right to access all "relevant" documents and records at no cost.

If a denial or appeal is based on an internal rule, guideline, or protocol, the notice must identify it and either include the rule or state that a copy will be provided upon request.

To ensure impartiality, the individual reviewing an ERISA appeal cannot be the same person - or report to the person - who made the initial claim decision.

Plans must update their internal claims and appeals procedures and revise the corresponding SPD sections accordingly.

Extensions for plan responses are limited to exceptional situations beyond the plan's control.

Commercial Payer Compliance Differences

Unlike ERISA, commercial payer appeals are governed by state-specific requirements. These include varying forms, submission methods, and evidentiary standards. Providers must also meticulously document all communications and actions related to each claim and appeal, as this is critical for compliance and success.

Managing Timelines

ERISA appeals have a strict 180-day filing deadline, which supersedes state laws and contractual terms. In contrast, commercial payer deadlines range from 30 to 180 days depending on the payer. Additionally, employers must respond to written requests for ERISA-related documents within 30 days to avoid penalties of up to $110 per day.

These foundational compliance steps pave the way for implementing best practices that enhance appeal outcomes.

Best Practices for Appeal Success

Adhering to compliance requirements is just the beginning. To improve revenue recovery, providers should adopt strategies that strengthen their appeals process.

Clear and Comprehensive Documentation

Accurate documentation is the backbone of any successful appeal. Providers need to ensure their records and coding clearly establish the medical necessity of the services provided.

Standardized Templates for Appeals

Using standardized templates can streamline the appeals process and improve consistency. Holly Ridge, Manager of Medical Necessity and Authorization Denials at Duke Health, highlights their importance:

"Templates look cleaner, more organized, and can look more professional. Templates can also help provide content reminders to staff as they write their appeals."

Templates should address various scenarios, such as authorization denials, Medicare denials, and commercial payer denials. Many electronic billing systems even offer preloaded templates to simplify this process further.

Leveraging Supporting Evidence

Strong appeals rely on robust supporting evidence. Providers should reference relevant payer policies (e.g., Medicare NCDs, LCDs, and Medicare Advantage policies), as well as federal and state regulations like the ACA and ERISA. Supplementing these with society guidelines, medical literature, and NCCI guidelines can further strengthen the case.

Tracking and Analyzing Denials

Effective appeals management requires systematic tracking. Providers can use spreadsheets, billing work-queues, or integrated appeals management systems to monitor open denials. Analyzing denial trends can help identify areas for improvement, refine coding practices, and focus staff training efforts.

Strengthening ERISA Appeals

For ERISA appeals, having well-crafted assignments of benefits (AOBs) is essential. A strong AOB allows providers to act on behalf of patients during the appeals process, ensuring all rights under ERISA are upheld.

Tackling Industry Challenges

Managing appeals effectively is critical to minimizing revenue loss. Even when claims seem clean, third-party payers may deny them initially, banking on the likelihood that providers won’t appeal. This practice leads to significant financial losses, as data shows that 50% of providers do not contest these incorrect denials. Moreover, poorly constructed appeals can further disadvantage providers by preserving payer capital.

A robust appeals process not only addresses these challenges but also boosts overall practice revenue. Some providers choose to partner with specialized services like JXH Recovery, which operates on a performance-based model, eliminating upfront financial risks while managing the intricate demands of ERISA and commercial payer appeals.

Conclusion

ERISA and commercial payer appeals represent two distinct avenues for healthcare revenue recovery, each with its own rules, challenges, and opportunities. ERISA appeals operate under federal law, while commercial payer appeals are subject to state-specific regulations. This regulatory divide creates notable differences in how providers approach and achieve financial recovery.

Grasping these distinctions is essential for improving revenue recovery efforts. For instance, major insurers like UnitedHealth Group reported a staggering 44% profit increase in the first quarter of 2021, which adds pressure on healthcare providers to recover revenue lost to denied claims. Despite this, ERISA appeals are used in less than one percent of all denied claims, leaving a massive opportunity untapped.

The complexity of ERISA appeals often deters providers, as many financial teams lack the expertise needed to handle federal-level disputes effectively. This issue is compounded by the fact that half of healthcare providers never challenge incorrect denials, allowing insurers to hold onto funds that should be reimbursed.

Specialized expertise plays a key role in maximizing appeal outcomes. Insurers routinely deny or underpay claims, relying on the assumption that policyholders won’t pursue appeals. Firms specializing in appeals can analyze denial patterns, often uncovering systematic underpayments that insurers struggle to justify. These firms frequently employ former insurance professionals to negotiate directly with payers, securing full payments without incurring legal expenses. This approach is not only effective but also cost-efficient, as attorney-led claims appeals can be eight times more expensive than other methods.

For healthcare providers aiming to recover lost revenue, success lies in recognizing that ERISA and commercial payer appeals require tailored strategies and deep expertise. Organizations like JXH Recovery offer performance-based solutions that minimize upfront financial risks while applying the specialized knowledge needed to navigate these complex processes. By leveraging such expertise, providers can turn previously written-off claims into recovered revenue, strengthening their financial position in an increasingly challenging landscape.

FAQs

What are the main benefits of choosing ERISA appeals over commercial payer appeals for healthcare providers?

Advantages of ERISA Appeals for Healthcare Providers

ERISA appeals provide healthcare providers with a valuable chance to address underpaid or denied claims through a structured review process. This process is designed to ensure a thorough and equitable review, giving providers a second opportunity to recover revenue that might otherwise slip through the cracks.

One standout benefit of ERISA appeals is their faster decision timelines compared to traditional commercial payer appeals. This efficiency not only helps providers address claim disputes more quickly but also reduces the administrative burden on their teams. By utilizing ERISA appeals, providers can protect their financial health while streamlining their claim resolution efforts.

What are the main differences in timelines and documentation requirements for ERISA and commercial payer appeals, and how can providers effectively handle them?

The timelines and documentation requirements for ERISA appeals and commercial payer appeals differ quite a bit. ERISA appeals come with stricter deadlines, typically requiring submissions within 60 to 180 days after a denial. Decisions on these appeals are usually made within 60 days of filing. In contrast, commercial payer appeals often provide more leeway, with deadlines that can range widely - sometimes stretching several years, depending on the payer and specific circumstances.

To navigate these differences successfully, healthcare providers should consider the following strategies:

Keep meticulous records of all claims and denials to avoid missing critical details.

Develop a reliable system to monitor appeal deadlines for both ERISA and commercial payers.

Focus on ERISA appeals first due to their tighter deadlines, while preparing for the potentially extended timelines of commercial appeals.

By staying organized and proactive, providers can better manage these processes and increase the likelihood of recovering claims in both cases.

Why don’t healthcare providers use ERISA appeals more often, even though they can improve recovery rates?

Healthcare providers often shy away from ERISA appeals because the process can seem daunting. The rules and procedures involved are intricate, and many providers aren't fully aware of the rights and benefits these appeals can unlock. This gap in understanding often results in missed chances to recover claims.

What makes ERISA appeals even more challenging is that they’re governed by federal regulations, which adds layers of complexity. They tend to require more time and resources than standard commercial payer appeals. On top of that, many providers lack the specific expertise or tools needed to handle these claims efficiently. Because of this, even though ERISA appeals have the potential to boost revenue recovery significantly, they often go unused.

Blogs

Blogs

Blogs

Read More

02/01/2025

5 mins

ERISA Appeals vs Commercial Payer Appeals: Key Differences

Read More

02/01/2025

5 mins

ERISA Appeals vs Commercial Payer Appeals: Key Differences

Read More

02/01/2025

5 mins

ERISA Appeals vs Commercial Payer Appeals: Key Differences

Read More

02/01/2025

5 mins

5 Steps to Appeal Denied Healthcare Claims

Read More

02/01/2025

5 mins

5 Steps to Appeal Denied Healthcare Claims

Read More

02/01/2025

5 mins

5 Steps to Appeal Denied Healthcare Claims

Reclaim Your Revenue

Is your facility losing money to denied claims? Let's fix that. Reach out today to learn how our recovery model can strengthen your bottom line without disrupting your operations.

Reclaim Your Revenue

Is your facility losing money to denied claims? Let's fix that. Reach out today to learn how our recovery model can strengthen your bottom line without disrupting your operations.

Reclaim Your Revenue

Is your facility losing money to denied claims? Let's fix that. Reach out today to learn how our recovery model can strengthen your bottom line without disrupting your operations.

Business Hours

Monday - Friday

8:30 AM - 6:00 PM EST

ERISA Appeals vs Commercial Payer Appeals: Key Differences

When healthcare providers face denied claims, they can pursue two main appeal paths: ERISA appeals (governed by federal law) and commercial payer appeals (regulated by state laws and payer contracts). Both serve to recover lost revenue but differ significantly in rules, timelines, and strategies.

Key Takeaways:

ERISA Appeals: Apply to self-insured plans under federal law. They offer standardized processes, extended timelines (up to 10 years for retroactive claims), and protections like anti-retaliation rules. Governed by the U.S. Department of Labor.

Commercial Payer Appeals: Apply to private insurance plans. These follow state-specific regulations and contract terms, making the process more variable and complex. Timelines and requirements vary widely by state and payer.

Quick Overview:

ERISA appeals provide a consistent framework but are underutilized (less than 1% of denied claims). They often yield better recovery rates due to federal preemption.

Commercial payer appeals are more common but demand tailored approaches for each payer and state, often requiring multiple attempts to overturn denials.

Understanding the distinctions between these two processes is critical for maximizing claim recovery and ensuring compliance. Below, we’ll break down their legal frameworks, processes, and impact on provider revenue.

Unlocking ERISA: How to Win Appeals When the Stakes Are High

Legal Framework and Governing Rules

The rules for handling ERISA and commercial payer appeals come from two distinct regulatory systems. For healthcare providers, understanding these differences is key to successfully navigating both processes.

ERISA Governing Laws

ERISA, short for the Employee Retirement Income Security Act of 1974, is a federal law that sets minimum standards for private retirement and health plans. It creates a nationwide regulatory framework that typically overrides state laws.

"ERISA requires plans to provide participants with plan information including important information about plan features and funding; sets minimum standards for participation, vesting, benefit accrual and funding; provides fiduciary responsibilities for those who manage and control plan assets; requires plans to establish a grievance and appeals process for participants to get benefits from their plans; gives participants the right to sue for benefits and breaches of fiduciary duty..."

The U.S. Department of Labor (DOL), through the Employee Benefits Security Administration (EBSA), oversees ERISA appeals. This federal oversight ensures consistent rules across the country and allows ERISA to override state laws and payer contracts - especially helpful for out-of-network claims. ERISA’s reach is extensive, applying to insurance policies that cover over 135 million beneficiaries.

ERISA also includes specific disclosure rules that benefit healthcare providers. For example, plan administrators must supply a Summary Plan Description (SPD) within 90 days of coverage starting and respond to requests for plan documents within 30 days. Additionally, ERISA includes anti-retaliation protections, ensuring that insurance companies cannot withhold benefits as a form of punishment. These protections extend to healthcare providers serving policyholders.

However, ERISA has its limits. It does not cover group health plans run by governmental entities, church-based plans for employees, or plans created solely to comply with workers' compensation, unemployment, or disability laws.

While ERISA provides a standardized, federally governed process, commercial payer appeals follow state-specific rules and contractual agreements.

Commercial Payer Governing Laws

Unlike ERISA’s consistent federal framework, commercial payer appeals operate under state-specific regulations and individual contracts, which can vary widely depending on the jurisdiction.

State insurance regulators are the primary authorities for overseeing private health insurance. They license insurers and enforce financial requirements specific to their state laws. This creates a patchwork of regulations that healthcare providers must navigate, often requiring different approaches in each state.

For commercial payer appeals, the terms of contracts between providers and payers play a central role. These agreements dictate the appeal processes, timelines, and requirements, which can differ significantly from one payer to another. Unlike ERISA, there’s no standardized process - providers must follow the specific terms outlined in each contract.

State-to-state variations add an extra layer of complexity. Each state has its own insurance codes, appeal rules, and consumer protection laws. For example, the process for appealing a denial in California will differ from the process in Texas or New York.

Another key difference is enforcement. While ERISA operates under federal authority, commercial payer appeals are governed by state laws and contracts. This means providers cannot rely on federal standards to challenge payer decisions. Instead, they must work within the constraints of state-specific rules, which can be more restrictive - especially for out-of-network claims.

State insurance departments are typically responsible for enforcing commercial appeal rules. This localized oversight can be beneficial in some cases, but it also means that enforcement and remedies vary depending on each state’s resources and priorities.

For healthcare providers, these differences underscore the need for state-specific knowledge and careful attention to contract details when handling commercial payer appeals. These legal distinctions shape the strategies providers must use to recover revenue.

Appeals Processes and Timelines

The appeals processes for ERISA plans and commercial payers differ significantly, creating unique challenges for healthcare providers trying to recover revenue. Each system comes with its own set of rules, documentation requirements, and deadlines, all of which can impact the success of an appeal.

ERISA Appeals Process

The ERISA appeals process is governed by federal law, offering specific protections and rights for participants. When a claim is denied, the plan administrator is required to provide a detailed denial letter. This letter must include the reasons for the denial, the relevant sections of the plan supporting the decision, and clear instructions on how to appeal the decision.

"The most important way to assert your rights and collect the benefits you deserve is to file an ERISA appeal." - Peace Law Firm

One key feature of this process is the opportunity for providers to submit additional evidence and arguments to support their case. This not only increases the chances of overturning the denial but also helps create a robust record for potential legal action if the administrative process doesn’t resolve the issue. Importantly, providers must exhaust all administrative remedies before taking the matter to federal court. ERISA also includes anti-retaliation protections, shielding providers from punitive actions by insurers.

Another advantage of ERISA appeals is the extended timeline for addressing underpayments or denials. Claims can be pursued retroactively for up to ten years, which can be a game-changer for providers dealing with long-standing payment issues.

Commercial Payer Appeals Process

Commercial payer appeals, on the other hand, are governed by a patchwork of state laws and individual contracts, making the process more fragmented and complex. Providers must navigate varying requirements, which often include multiple levels of review, such as external reviews conducted by state agencies or the Department of Health and Human Services.

When prior authorization is denied, providers often need to include a statement of medical necessity from the ordering physician. Appeal letters must be customized to address the specific payer and jurisdiction, explaining the medical necessity of the service, detailing the tests performed, and citing published evidence to support the claim. Because these appeals are contractually driven, the procedures, deadlines, and documentation requirements can vary widely, making it essential for providers to thoroughly review each payer contract.

This variability demands a flexible and organized approach to ensure deadlines are met and appeals are submitted correctly.

Timeline Comparison

The timelines for ERISA and commercial payer appeals differ significantly, which can affect how providers approach their revenue recovery strategies.

Under ERISA, the process is more standardized. Claim decisions are typically made within 45 days, with an additional 45-day extension allowed for disability appeals. Accidental death claims must be appealed within 60 days. After administrative remedies are exhausted, there’s no strict federal deadline for further legal action, as courts often rely on state statutes of limitations.

In contrast, commercial payer timelines are far less predictable. They vary depending on state regulations and the terms of individual plan agreements. Some plans may request additional documentation or grant extensions, which can stretch the process well beyond ERISA’s more structured timeframes. In some cases, it may take over a year to fully resolve an appeal and recover revenue.

These differences highlight the importance of strategic planning. ERISA’s federal framework provides clearer deadlines, while commercial payer appeals require careful tracking of multiple, often shifting, timelines. Providers must maintain meticulous records of all deadlines and ensure timely submissions to protect their rights and maximize recovery efforts.

Key Differences Comparison

When comparing ERISA and commercial payer appeals, their distinctions become clear through a side-by-side review. ERISA appeals operate under a uniform federal framework, while commercial payer appeals are shaped by diverse state laws and specific contract terms.

ERISA is governed by federal law, which typically overrides state regulations and payer contracts. This federal oversight ensures consistency across all states. For instance, private self-insured employer-sponsored plans fall under the jurisdiction of the U.S. Department of Labor, while state and local government plans are monitored by the Centers for Medicare and Medicaid Services (CMS). On the other hand, commercial payer appeals are regulated at the state level, applying to a variety of insurance products that don’t fall under ERISA.

The scope of coverage also diverges significantly. ERISA oversees benefits for about 165 million individuals under 65 with employer-sponsored coverage as of 2023. This includes a wide range of plans, such as health, disability, and life insurance. Commercial payer appeals, however, vary depending on the state and the specific type of plan.

Another key difference lies in documentation requirements. ERISA enforces standardized and timely documentation, whereas commercial payer appeals follow state-specific rules, which can differ greatly depending on the jurisdiction.

Side-by-Side Comparison Table

Attribute | ERISA Appeals | Commercial Payer Appeals |

|---|---|---|

Governing Law | Federal Law (ERISA) | State Law, Contract Law |

Regulatory Authority | U.S. Department of Labor, CMS | State Insurance Commissioners |

Coverage Scope | 165 million employer-sponsored plan members | Varies by state and plan type |

Appeal Timeline | 45 days (+ extensions available) | Varies by state and contract |

Appeal Deadline | 180 days from denial notice | Varies by state and contract |

Look-back Period | Up to 10 years | Limited by state law and contract terms |

Documentation Response | 30 days for plan documents | Varies by state requirements |

Resolution Venue | Federal Courts | State-level processes |

Legal Remedies | Exclusive federal civil remedies | State-specific remedies |

The differences between these frameworks have a direct impact on financial recovery strategies in healthcare. Despite a 23% increase in claim denials from 2016 to 2020, hospitals rely on ERISA appeals for less than 1% of all denied claims. This underutilization is notable, given the potential benefits ERISA offers.

Enforcement mechanisms also highlight the contrast. ERISA provides exclusive but limited civil remedies, allowing providers to escalate cases to federal court once administrative remedies are exhausted. In contrast, disputes involving commercial payers are resolved through state-level processes, which vary widely.

These regulatory and procedural differences not only shape appeal outcomes but also influence how healthcare providers approach revenue recovery. ERISA’s federal preemption offers a significant advantage by overriding payer contracts and state laws in most cases. Providers working with ERISA plans benefit from a consistent legal foundation, while those handling commercial payer appeals must navigate a patchwork of state regulations and contract-specific terms.

Ultimately, these contrasts explain why ERISA appeals often lead to better recovery rates and more stable long-term revenue opportunities. Meanwhile, commercial payer appeals demand tailored strategies that align with unique state and contract requirements.

Impact on Healthcare Revenue Recovery

The differences between ERISA and commercial payer appeals significantly shape how healthcare providers recover lost revenue. These distinctions influence their strategies and determine which methods are most effective for improving financial outcomes.

Effect on Claim Recovery Approaches

ERISA appeals provide a distinct advantage for healthcare providers looking to recover revenue. Unlike commercial payer appeals, ERISA allows recovery on older claims that typically fall outside standard statutory limits. This opens up opportunities to reclaim funds that might otherwise be written off as losses.

For example, a 13-hospital system managed to recover $87,003 in its first month of ERISA appeals and a total of $6,551,887 over 25 months. They also had $7.7 million under appeal and $14.8 million pending. In another case, a healthcare provider grew its ERISA recovery from $141,000 in the first month to $1.1 million by the fourth month.

On the other hand, commercial payer appeals present a tougher challenge. Private payers deny about 15% of first-pass claims. While 54% of these denials are eventually overturned, it often requires multiple attempts, adding both time and expense. Each appeal costs around $44, and the average financial loss per denial exceeds $14,000. Alarmingly, 22% of healthcare organizations report losing over $500,000 annually due to denied claims.

A key to success in ERISA appeals lies in adopting an educational rather than adversarial approach. Andre Kus, CEO of JXH Recovery, explains:

"JXH Recovery understands hospitals have long-term relationships with insurance companies, so we try to use an educational approach in our negotiations with payers."

This strategy leverages ERISA's federal preemption, which overrides most payer contracts and state laws, giving providers a stronger position in negotiations.

In contrast, commercial payer appeals require a more tailored strategy. Providers must account for state-specific regulations, contract terms, and the nuances of different insurance products. Medicare Advantage plans add another layer of complexity, with denials increasing by nearly 56% and those tied to net patient revenue rising by more than 63%.

These operational differences emphasize the importance of specialized expertise, which is explored further below.

Role of Specialized Services

The growing complexity of ERISA and commercial payer appeals highlights the need for specialized services. Managing these appeals internally can be overwhelming, especially with the rise in claim denials.

JXH Recovery offers targeted solutions for both types of appeals. Their ERISA service focuses on recovering claims that seem unrecoverable through conventional methods, while their commercial payer service navigates the intricate maze of state regulations and private insurer requirements. By using a performance-based model, they eliminate upfront costs, reducing financial risk for providers.

The scale of unpaid claims in the healthcare industry underscores the importance of expertise. A survey of 772 hospitals found that half reported having over $100 million in unpaid claims older than six months, amounting to more than $6.4 billion in delayed or denied payments.

The knowledge required for ERISA appeals differs greatly from that needed for commercial payer appeals. ERISA cases rely on federal laws, extensive case history, and amendments, while commercial appeals demand familiarity with state regulations and individual contracts. This difference explains why providers often achieve better results when working with recovery specialists instead of handling appeals internally.

Beyond immediate recoveries, ERISA appeals can uncover patterns of underpayment through data analysis, strengthening future claims. Similarly, specialists managing commercial payer appeals can identify trends in denials and overturned claims, helping providers refine their submission strategies. These insights can lead to long-term financial improvements and better claim management.

Compliance Requirements and Best Practices

Navigating the complexities of regulatory frameworks is crucial for healthcare providers aiming to optimize revenue recovery through ERISA and commercial payer appeals. Understanding the specific obligations tied to each process ensures compliance and sets the stage for successful outcomes.

Required Compliance Steps

ERISA Compliance Essentials

ERISA appeals fall under federal law, which provides uniform regulations across all states. The Department of Labor mandates that healthcare providers adhere to several key requirements when pursuing these appeals. For example:

Plans must provide a Summary Plan Description (SPD) within 90 days and deliver requested plan documents within 30 days.

Participants have the right to access all "relevant" documents and records at no cost.

If a denial or appeal is based on an internal rule, guideline, or protocol, the notice must identify it and either include the rule or state that a copy will be provided upon request.

To ensure impartiality, the individual reviewing an ERISA appeal cannot be the same person - or report to the person - who made the initial claim decision.

Plans must update their internal claims and appeals procedures and revise the corresponding SPD sections accordingly.

Extensions for plan responses are limited to exceptional situations beyond the plan's control.

Commercial Payer Compliance Differences

Unlike ERISA, commercial payer appeals are governed by state-specific requirements. These include varying forms, submission methods, and evidentiary standards. Providers must also meticulously document all communications and actions related to each claim and appeal, as this is critical for compliance and success.

Managing Timelines

ERISA appeals have a strict 180-day filing deadline, which supersedes state laws and contractual terms. In contrast, commercial payer deadlines range from 30 to 180 days depending on the payer. Additionally, employers must respond to written requests for ERISA-related documents within 30 days to avoid penalties of up to $110 per day.

These foundational compliance steps pave the way for implementing best practices that enhance appeal outcomes.

Best Practices for Appeal Success

Adhering to compliance requirements is just the beginning. To improve revenue recovery, providers should adopt strategies that strengthen their appeals process.

Clear and Comprehensive Documentation

Accurate documentation is the backbone of any successful appeal. Providers need to ensure their records and coding clearly establish the medical necessity of the services provided.